The war on healthcare fraud in America has hit an all time height in activity, as the annual cost and loss due to fraudulent medical billing totals tens […]

Health News

Posted on:

4 Common Types Of Healthcare Fraud and How You Can Avoid Them

The healthcare sector in the United States offers some of the highest-paying jobs in the country. But, it also loses a large amount of money on healthcare fraud […]

News

Posted on:

Secrets To Making A Claim On Emotional Distress

Most emotional distress claims are components of physical personal injury claims. For example, somebody who has been paralysed in a car crash may now be suffering from deep […]

Education

Posted on:

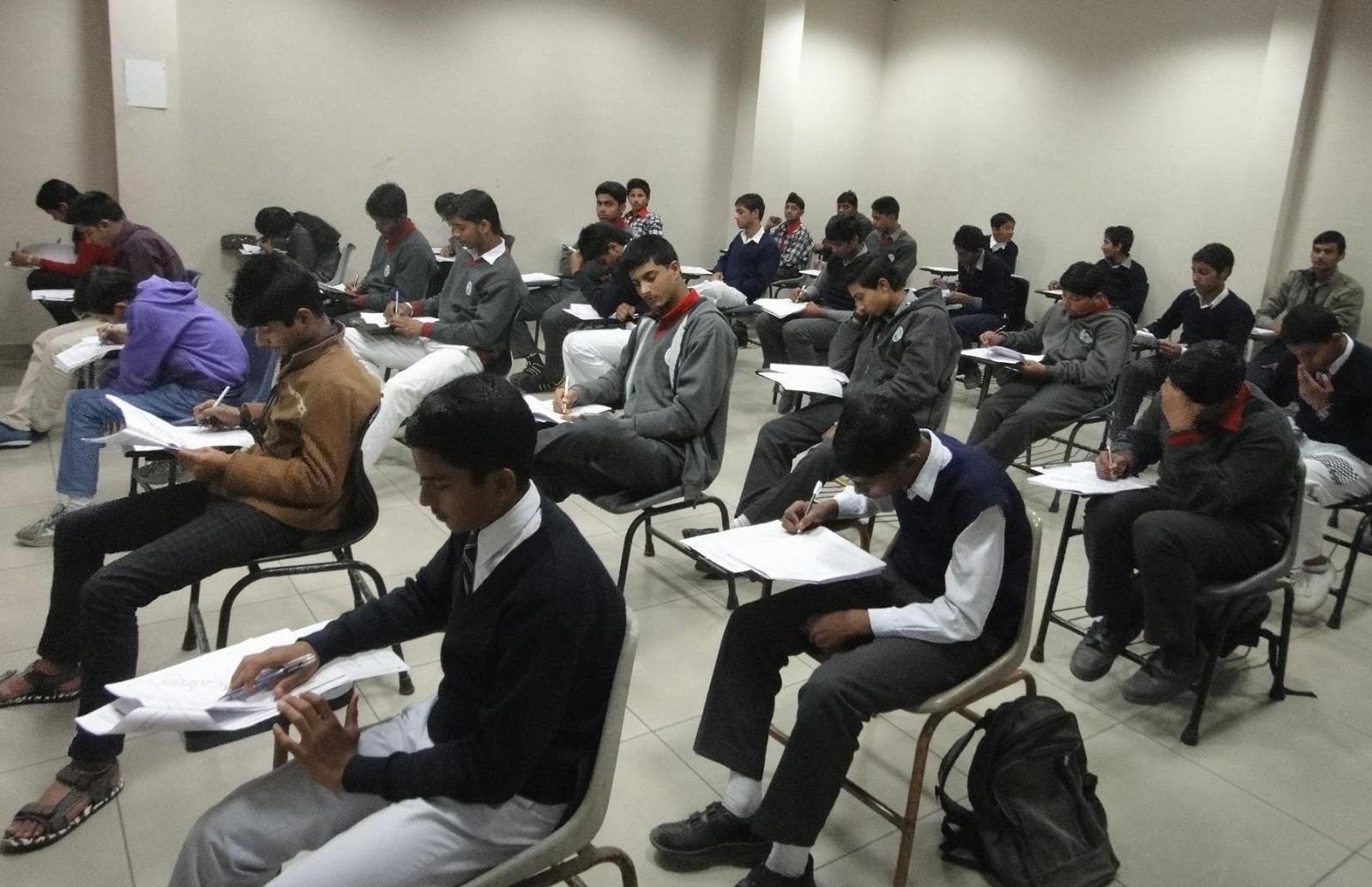

Law Entrance Examinations In India

Law or legal education in India has primarily one objective, i.e. to enable students become practicing lawyers after going through extensive legal research, education and training at nationally […]