There are more personal finance apps available for Android than ever before, so it’s important to sift through and find out which are best for meeting your personal financial needs and goals. The must-have apps below will help you get ahold of your expenses and stay on track to meet savings goals. In addition, apps like Acorns are helping everyday people to use their spare change to grow their wealth. Keep reading to find out which of the best personal finance apps will take the headache out of managing business and travel expenses, credit scores, and depositing checks from your smart phone.

Wally+

Wally+ helps you to manage your expenses and meet savings goals. The app not only tracks what you spend, but also where and with whom you spend your money. Turn on location services, and all you need to do is enter how much you spent. The app automatically identifies and categorizes the place you’re at. Wally+ uses artificial intelligence and advanced algorithms to constantly learn more about your spending and saving patterns to help you better manage your finances.

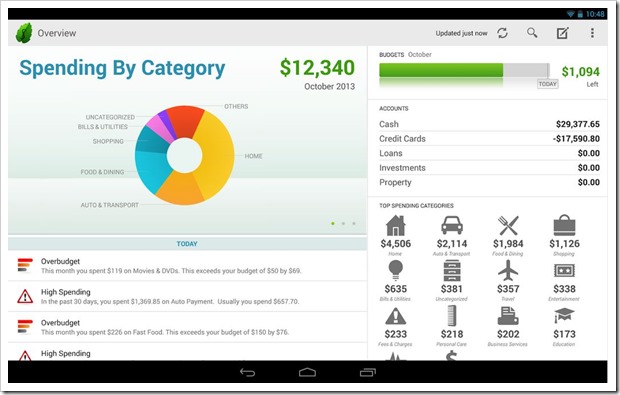

Mint

Mint enables you to see all of your accounts in one place, including checking, savings, credit cards, and 401k. It also helps to manage bills and sends automatic payment reminders. The app provides users with valuable financial insight into their spending and saving patterns, including detailed charts and graphs on the Android tablet version. Plus, it provides financial advice, which identifies products to help you save more and avoid ATM fees.

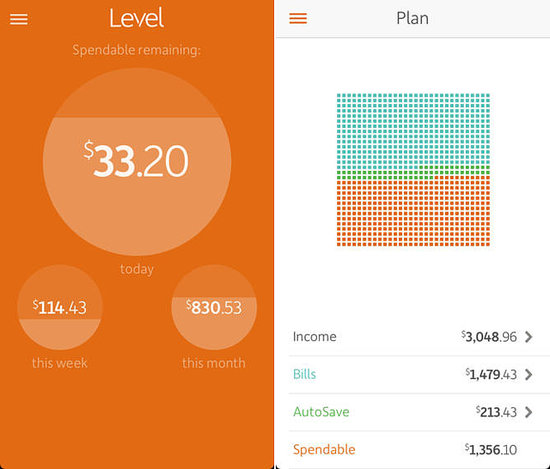

Level Money

Level Money is great for tracking daily expenses. The app helps to create a monthly budget, based on your spending patterns and savings goals. You get a breakdown of how much money you can spend each day, week, and month. Level Money stands apart from other financial apps because its layout is ultra user-friendly and presents financial targets and information in an easy to read format.

Acorns

Acorns makes investing easier and more accessible than ever. Once you link your bank accounts and credit cards, Acorns rounds up to the next dollar on each transaction you make. The difference is automatically invested into a diversified portfolio. You can start investing once your spare change reaches $5 or with a lump sum deposit. To start, the cost is just $1 per month. As your investments grow, you’ll pay ETF management fees between 0.25-0.5 percent of your portfolio, which is still much less than traditional wealth management services. Plus, you choose the risk level and pay no trade commissions.

Expensify

For business travelers and small business owners, Expensify is an absolutely necessary app. Use it to automatically record travel or business-related expenses by scanning receipts. The app uses the information stored to generate expense reports. Stop worrying about lost receipts because Expensify can use credit card transaction histories to generate IRS guaranteed eReceipts for expenses under $75. Download the app to a mobile device with a long-lasting battery like the Sony Xperia Android phone, and you can forget about the old stresses of business travel and receipt collecting. Add the fact that the Xperia Z3 features a waterproof design, and your travels will be entirely stress-free.

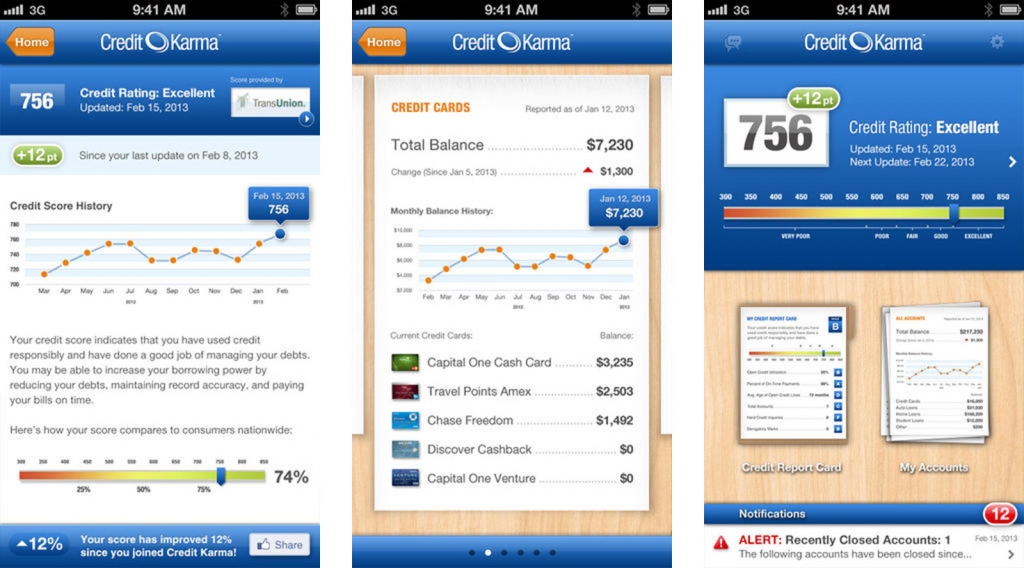

Credit Karma

Thanks to Credit Karma, there’s no more paying for credit reports or waiting a year to get your free credit scores. This app shows you your credit scores and reports from TransUnion and Equifax each week for free. Viewing your score on the app does not affect your credit score, and you can turn on push notifications to receive credit alerts.

Mobile Check Deposit

Lastly, say goodbye to bank lines and even to driving to the ATM to deposit paper checks. Android users must have their bank-specific apps to benefit from mobile check deposit. Most major U.S. banks, including Chase, Bank of America, and Wells Fargo already offer mobile check deposit. However, do not fret if you bank locally or with a credit union, many smaller financial institutions, like Oregonians Credit Union, the Navy Federal Credit Union, and Central Bank of the Midwest, also offer mobile check deposit to their customers.

You don’t have to be a financial whiz to get your finances on track. Let the best personal finance Android apps and your smart phone do the work for you.