Content Development is the gold statement in the internet publishing and race to be on top of search engines and the first page of search results. The emerging […]

The Basic Regarding Margin That You Must Be Aware Of

Do you do trading in commodities? If you do then you must have certain basic knowledge about certain factors so that you can do effective trading and earn […]

Is A Hard Loan A Good Investment Tool For Your Situation?

Getting a mortgage today is nowhere as easy as it used to be. Less expensive interest-wise, if you don’t have the right assets or income to debt ratio, […]

Things To Know Before Considering A Business Loan In Singapore

Regardless of whether you’re just starting up a business or expanding it, you will always find a reason to apply for business loans in Singapore. Having this type […]

Investing In Precious Metals 101

Precious metals have always been recognized as valuable, as their name clearly portraits it. Their value is especially significant in times of crises, such as war, political or […]

5 Reasons Your Credit Score Is Low

Why is my credit score is low? This is perhaps one of the most common questions most individuals ask themselves when they find out they have a low […]

How Can Freelancers Enjoy More Financial Security?

When self-employed, the matter of financial insecurity tends to overshadow the liberties and all other advantages. Lately, the industry has been graced by the presence of a new […]

Basics Of An Smsf In Diy Super Online

For those running the self-managed super fund, they are obviously aware that being an SMSF member can be more of a challenge than when one belongs to a […]

Management Of Projects In A Better Way

Association’s most vital and income creating perspectives are the ventures and representatives that ought to be overseen adequately so as to make business and benefit for the associations. […]

How To Enable Yourself For A Better Career In Finance?

“Everyone has been made for some particular work, and the desire for that work has been put in every heart.”And, if you are the one who keeps desire […]

Benefits of hiring an IT company in Melbourne

Business IT support is very important to every business. It does not matter what kind of an enterprise you run, whether, web hosting, or uploading videos. Clever tactics […]

5 Things You Can Do Today To Improve Your Credit Score

Having bad credit can be like a stone tied to your ankles. The sensation of drowning in debt is not fun for anyone. When your credit rating is […]

Internet Marketing And Its Importance

It is interesting to see that internet has greatly changed the way of buying and selling products. In hectic lifestyles, people are mostly into online shopping. They have […]

Flexible Schedules Are Now Available With Good Mentoring Services

Running a successful business field is now a piece of cake for many. All you need to do is just get acquainted with the reliable companies first, and […]

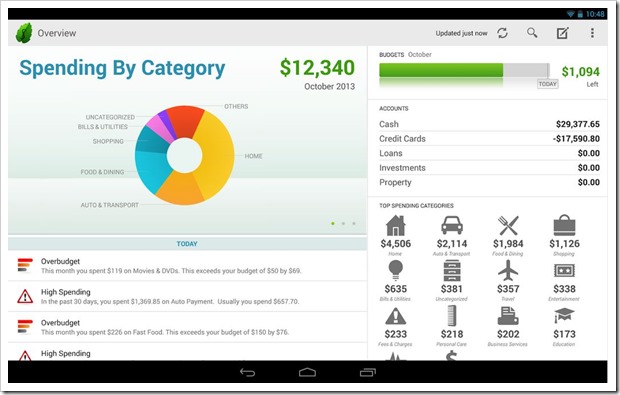

Must-Have Personal Finance Apps On Android

There are more personal finance apps available for Android than ever before, so it’s important to sift through and find out which are best for meeting your personal […]

Top Tips For Small-Business Online Marketing

Small-business owners are often short of two things – time and money. So when it comes to maintaining an effective marketing strategy for their online presence, this can […]